#19 Frameworks (and AI) for marketers who think before they pitch

Your brain’s not broken — it’s just missing a framework (and a little help from AI)

Why frameworks matter more than ever

Ever feel like you’re solving five problems at once? Only to find ten more waiting?

You’re not alone. Metrics dip. Budgets shift. New segments appear overnight. And mid-sprint, someone always asks, “Wait… what are we trying to do?”

Welcome to marketing. And product. And the everyday storm.

The good news? You don’t have to slow down to make sense of it.

That’s what frameworks are for. They’re thinking tools. They help you zoom out, organize chaos, ask smarter questions, reason to solve problems, and align teams without the endless back-and-forth.

Add AI, and they get even better. You move from vague ideas to a sharp strategy, faster, clearer, and with fewer blank pages.

This series breaks down the frameworks product marketers use to think more clearly and act faster. No fluff, no filler.

Takeaways

Today, we have picked four frameworks to understand business and product strategy to make faster and better decisions.

Lean Canvas gives you a clear, one-page view of your business model so you can move with focus, not assumptions.

Product Vision Board locks in your direction and who you’re building for, so you stop building in the dark.

Strategy Triangle helps you align on where to play, how to win, and why this moment matters, so your strategy isn’t just a vibe.

Leader of Needs sharpens your message until it actually resonates—not just sounds nice.

AI can guide you through each framework step by step, helping you ask sharper questions, spot weak spots, and structure clearer thinking.

Start with this plug-and-play prompt:

“Help me complete a [Framework Name] for [Company/Product]. Ask me questions for each section, use public data if available, and push back when my answers are vague.”Business Model

Lean Canvas: The one-page business strategy

Let’s start here. The Lean Canvas is your company’s entire strategy... on a single page. Not a pitch deck. Not a Notion doc that no one reads. A clear, visual map that cuts through the noise.

It covers just the essentials:

Problem, Customer Segments, Unique Value Proposition, Solution, Channels, Revenue Streams, Cost Structure, Key Metrics, and Unfair Advantage.

Picture packing for a hike with one small bag. You only bring what matters. The Lean Canvas works the same way. Just focus.

Why marketers love it

Ever hunted down key product info across 20 Slack threads, two inboxes, and an old Google Doc last updated in 2021 by someone who has since left the company and now lives off-grid in Portugal?

Lean Canvas stops that. It pulls scattered knowledge into one shared space. Suddenly, product, design, sales, and marketing are on the same page—literally.

You can use it to:

Clarify your value prop

Define your core customer

Prioritize the right channels

Anchor every campaign in business reality

This is more than strategy. It’s alignment. Its direction. It’s a compass. Use it early. Use it often.

For You: 27 templates that are designed to streamline your product management process by a great Product Marketer, Maryna Kucherova.

Look in action: Lean Canvas – Klarna

Let’s review an example of one of my favorite and well-known companies and business models: Klarna.

1. Problem

Consumers struggle with high upfront costs and inflexible payment options for online purchases — leading to abandoned carts

Merchants lose sales and conversion due to friction at checkout and limited payment options.

Existing credit solutions are complex, slow, and depend on hard credit checks.

2. Customer Segments

Consumers: online shoppers (often millennials and Gen Z) interested in flexible, interest-free payment options

Merchants: e-commerce and in-store retailers seeking higher conversion, ticket value, and risk mitigation

3. Unique Value Proposition

"Flexible, smooth, and trust-first payment experience that boosts sales instantly."

Consumers get interest-free payment and easy checkout.

Merchants see conversion +30–44% and reduced abandonment

4. Solution

BNPL products: Pay in 4 installments, pay in 30 days, buy now pay later.

Klarna card & app: Enables in-store and mobile payments.

Technology: Soft credit checks, integration with e-commerce platforms (Shopify, Magento, etc.)

All tech-enabled, fast, and frictionless.

5. Channels

Embedded at merchant checkouts (both online and in-store)

Direct app downloads and Klarna marketing.

Partnerships with major retailers and financial institutions (e.g., Walmart pilot)

6. Revenue Streams

Merchant fees (2–8% per transaction, typically higher than credit cards)

Late fees/interest on unpaid installments

Interchange fees, licensing, advertising, and subscription (e.g., Klarna Plus)

7. Cost Structure

Tech & risk infrastructure — underwriting, fraud prevention, platform maintenance.

Operational — personnel (~3,400 employees), risk & collections teams

Marketing & partnerships — merchant acquisition, App Store presence, brand promotion.

Loan provisions — reserves against defaults; reported $136M credit loss Q1 2025

8. Key Metrics

Active users: ~100M globally

GMV: ~$80B processed in 2024

Conversion lift: +30–44% for merchants

Credit performance: default/loss trends (e.g., $136M, 17%)

North Star: GMV and combined user engagement (consumer + merchant).

9. Unfair Advantage

First-mover brand in global BNPL and strong merchant network (~675K merchants, 93M users)

Tech + risk stack: soft credit checks, fraud protection, risk underwriting.

Financial licensing & partnerships: bank license, debit card pilot, exclusive merchant deals.

Product Strategy

Product Vision Board: The big picture

Before roadmaps. Before features. Before sprints. You need a vision.

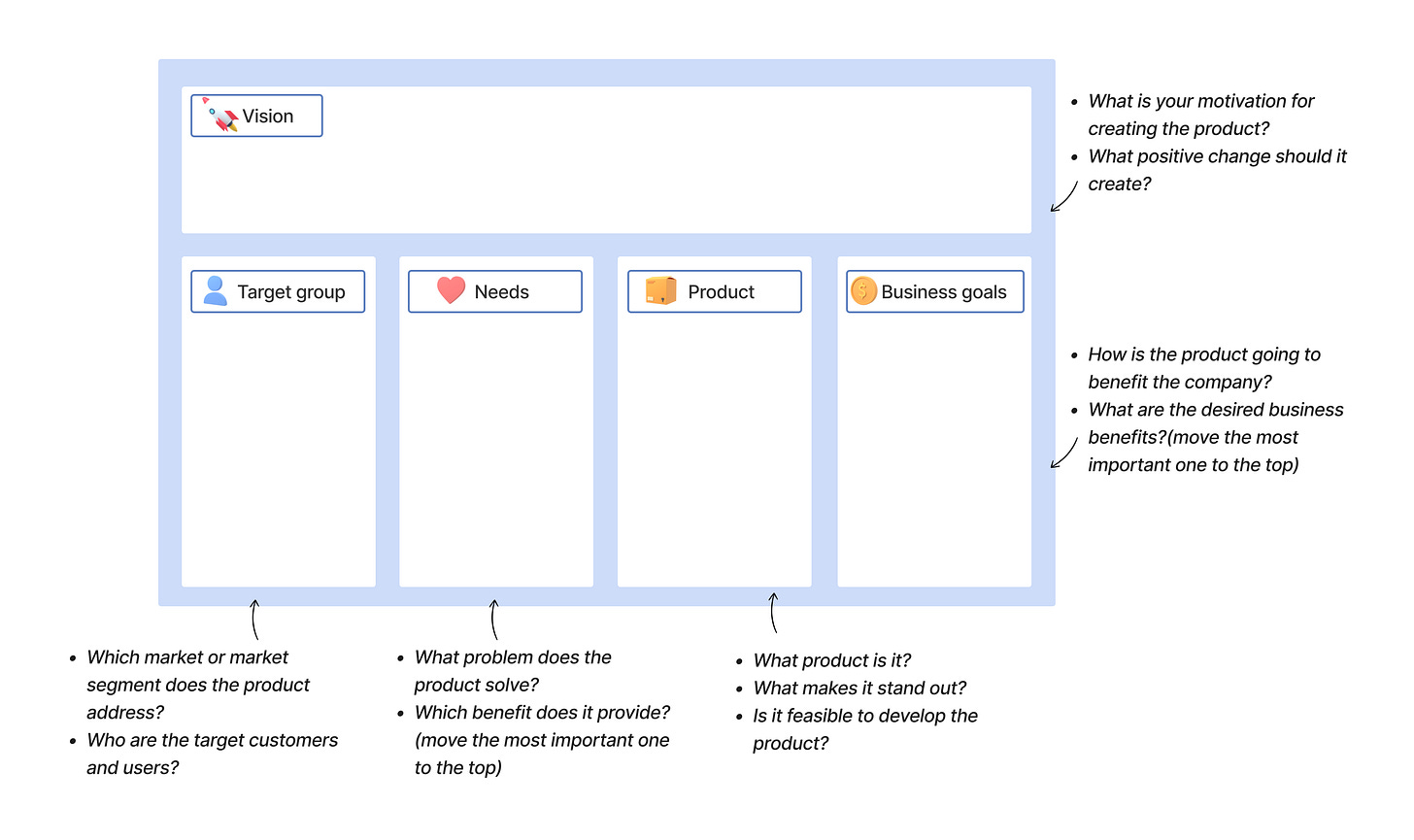

That’s where the Product Vision Board shines. It lays out five foundations:

Vision, Target Group, Needs, Product, and Business Goals.

Think of it as your map before the journey. You define where you’re going, who you’re helping, and why it matters, so every decision after that stays grounded.

Otherwise, you end up halfway to nowhere with a very detailed feature road

map and no idea why you’re building any of it. (Fun! But also not.)

Why marketers love it

In most fast-paced companies, the product vision lives inside someone’s brain, or in slide #87 of an old deck.

This framework brings it to light. You finally see the real “why” behind what you're building.

With this, marketers can:

Craft messaging that aligns with customer needs

Understand the business goals behind product bets

Build brand narratives that go deeper than “feature launch”

It’s your North Star. And it keeps everyone pointed in the same direction.

For You: 27 templates that are designed to streamline your product management process by a great Product Marketer, Maryna Kucherova.

Look in action: Klarna – Product Vision Board

1. Vision

Make payments simple, safe, and smooth, empowering consumers to take control of their finances and shop with confidence.

2. Target Group

Primarily online shoppers—especially Millennials and Gen Z—in markets across Europe and the U.S., plus merchants (e-commerce and in-store) seeking higher conversion and loyalty.

3. Needs

Consumers want flexibility and peace of mind when paying, with transparent options and no surprise charges.

Merchants need a smoother checkout, fewer abandoned carts, and a way to increase average order value.

Both want payment and credit handled securely and in real time, without rigid credit-card bureaucracy.

4. Product

A suite of BNPL options (Pay in 4, Pay in 30 days) with soft credit checks and integrated checkout.

A Klarna app and card for cross-channel payments, budgeting, and rewards.

Embedded integration with major platforms (Shopify, Stripe, etc.), full tech infrastructure including risk, fraud, and underwriting systems

5. Business Goals

Continue growing GMV (reached $105B in 2024) and expand user base (93M active users worldwide)

Boost merchant conversion, retention, and adoption of embedded credit products.

Diversify revenue by expanding banking services, subscriptions, advertising, and debit card offerings.

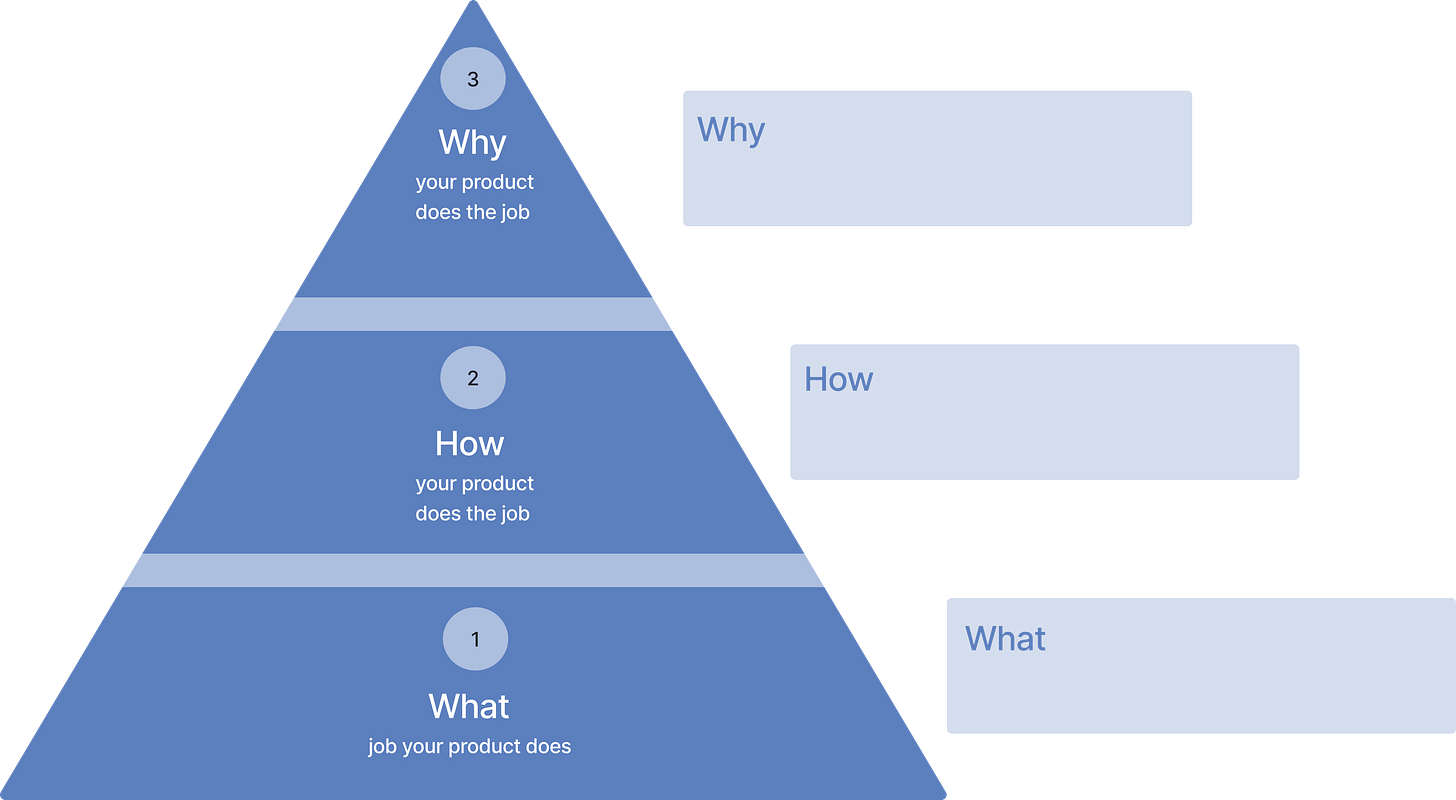

Strategy Triangle: Where, how, why.

This framework zooms out and asks the big questions:

Where to play?

Which market, customer, or channel matters most?

How to win?

What makes us different, and how do we deliver?

Why now?

What changed that makes this the moment?

Think of it like planning a road trip. Pick the destination, prep the car, wait for the green light.

Why marketers love it

Strategy isn’t just for the exec offsite. It’s for you.

This triangle helps marketers:

Build go-to-market plans that reflect market dynamic

Position products with relevance and urgency

Align tactics with the actual company strategy

When your messaging and channels match where you’re headed, things click. Teams get aligned. Campaigns get traction. You stop spinning and start moving.

Also, fewer existential meetings where someone asks, “Wait, why are we doing this again?” and no one has a satisfying answer.

Look in action: Klarna – Strategy Triangle

1. Where to Play

Markets: Global e-commerce across Europe and North America, expanding into in-store retail and travel sectors

Customers: Two main segments:

Consumers: Millennials and Gen Z seeking interest-free, flexible payment options

Merchants: Online and physical retailers aiming to increase conversion rates and order value

Channels: Integrated at checkout (online/in-store), mobile app, and through partnerships (e.g., Shopify, Stripe, DoorDash)

2. How to Win

Unique Value: Instant, transparent BNPL with no interest or surprise fees; plus seamless integration across channels and rewards via the Klarna app

Capabilities Required:

Sophisticated underwriting, fraud detection, and soft credit-check tech stack.

Global partnerships with merchants and financial institutions (e.g., Visa, Marqeta)

Scalable risk management to support quick payouts to merchants.

Moat: Strong brand recognition (93–100 M users), exclusive merchant integrations, exclusive banking license, and proprietary risk models based on massive transaction data.

3. Why Now

Market Shifts: BNPL has exploded post-COVID; global BNPL volumes are expected to grow ~13.7% in 2025 to $560 B

Consumer Behavior: Younger consumers prefer flexible payments and budgeting support — BNPL usage is outpacing traditional credit among Gen Z/Millennials

Technology & Regulation: Converging tech (apps, seamless checkout, AI risk tools) and evolving regulation (like FCA’s upcoming affordability checks) validate BNPL as a mainstream financial service.

Messaging frameworks

Leader of Needs: Positioning in three lines

What do you offer?

How does it solve a problem?

Why should anyone care?

It’s basically how you’d explain your product to a smart friend who’s two drinks in and has no patience for jargon.

This is the Leader of Needs. It takes your positioning and forces it into clarity—three lines, no filler.

Why marketers love it

You don’t have time for ten-slide decks and vague messaging. You need sharp, sticky, customer-first language.

Leader of Needs helps you:

Cut through the noise

Align with product and sales

Test value props with real users

Use the same message everywhere—from ads to investor decks

It brings clarity. And clarity converts.

Look in action: Klarna – Leader of Needs

What

What we offer: A suite of Klarna “Buy Now, Pay Later” plans — including Pay in 4, Pay in 30 Days, longer-term financing, a mobile app, and Klarna Card for seamless payments.

Core function: It allows users to split purchases into manageable, interest-free installments or defer payment without traditional credit hassles.

Customer-speak version: “Klarna lets me shop now and spread the cost — with no interest, no stress.”

How

Practical solution: Offers immediate financing at checkout with soft credit checks, automated installment scheduling, and return-friendly payment flexibility.

Differentiation: Unlike credit cards, it provides transparent, fixed-duration, interest-free payment plans with no surprises — and covers risk for merchants.

Unique experience: The seamless in-app experience and Klarna Card integration simplify budgeting — plus integrated merchant offers and rewards made for modern shoppers.

Why

Customer benefit: Provides flexible cash flow control without debt anxiety — shoppers can buy now and pay later, worry-free.

Timing factor: With consumer demand for flexible payments rising (especially among Gen Z and Millennials), and high abandonment rates in e-commerce, Klarna delivers timely solutions.

Motivator to switch: Shoppers lacking credit cards or seeking transparency choose Klarna for the simplicity, no-interest plans, and integrated payment experience — with added merchant benefits.

How AI supercharges frameworks

Frameworks are powerful. But they can still be slow. Hard to fill. Vague in practice. That’s where AI steps in, not to replace strategy, but to sharpen it.

Here’s how:

Before you prompt: Pick your AI mode wisely

4.0 is great for most of this. But if you're tackling something more complex, like unpacking a messy strategy, resolving contradictions, or mapping unknowns, try the reasoning model. It’s built for deeper thinking and structured problem-solving.

Need rich context or market data? Go with deep research mode.

Just looking for quick facts or a surface scan? A simple web search will do the job faster (and with less overthinking).

Choose based on the job. Sometimes, speed is the winner. Sometimes, you need something that can dig

1. Ask better questions

AI doesn’t give you random answers. It asks the questions that matter.

Like:

What do we measure to track traction?

What’s our unique moat?

Why would someone switch to us now?

These questions guide deeper thinking.

2. Combine public and internal knowledge

AI pulls from both:

Public sources (competitor sites, market reports, product pages)

Your internal docs (briefs, research, decks, interviews, notes)

So instead of guessing, you’re building on what’s real. Fast.

And no more starting from a blank doc while pretending you remember what was in that strategy workshop last quarter.

3. Turn vague into sharp

Got a fuzzy value prop like “We help people save time”? AI will push back. It’ll ask, How? For who? Why now? That pressure helps you refine.

You’ll spot weak spots. Fill gaps. And shape clearer, crisper ideas.

4. Craft a strategic story

Once your framework is filled, AI can help turn it into:

A landing page

A pitch deck

A one-pager for your team

Messaging for a product launch

So you go from brainstorm to execution faster with strategy baked in.

Plug-and-play AI prompt

Try this when working with any product framework:

Prompt:

“Help me complete a [Framework Name] for [Company/Product].

Step 1: Ask me specific and sharp questions for each section.

Step 2: Use public data and the info I provide.

Step 3: If my answers are vague, ask follow-ups and suggest improvements.”Use it for Lean Canvas, Strategy Triangle, Vision Boards—anything. It works like a strategic coach on call.

Final thought: The moment it clicked

I still remember one Monday morning when a PM dropped into my DMs and said,

“Hey, we need a messaging direction for this new feature. Can you help?”

I asked for context.

They sent me:

A screenshot of a spreadsheet

A Google Doc titled “Brainstorm_2_FINAL” (which wasn’t final)

A Slack thread with 17 replies and zero decisions

I spent the next two hours just trying to figure out what problem we were solving.

Everyone was working hard, but no one had a shared picture of the strategy.

That was the moment it clicked.

We didn’t need another meeting. We needed a framework.

A way to zoom out, get aligned, and think clearly as a team.

Frameworks stop the chaos from wasting your time, and when you bring AI into the mix, that clarity comes faster, with fewer gaps, and way less back-and-forth.

Try one. See if it helps clear things up. And if it does, send it to someone else who's stuck in a doc called “final_v3_revised.” They’ll thank you. Probably.